SoftBank invests $1bn in Korean e-commerce site

SoftBank continues its investment run, this time by ploughing $1bn into South Korea’s burgeoning e-commerce market

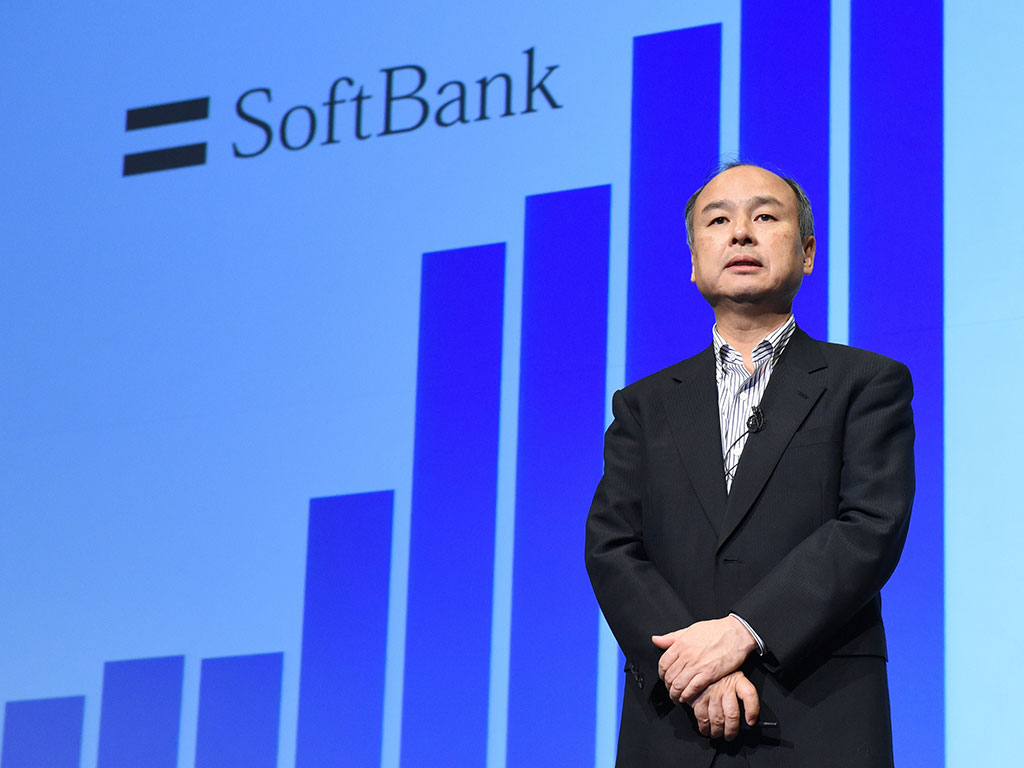

Masayoshi Son, President of Japan's SoftBank. The company has invested over $1bn into e-commerce giant Coupang

E-commerce giant Coupang is the latest of only a handful of Korean firms to have secured an over $1bn investment, courtesy of Japanese telecoms giant SoftBank, whose commitment to the country’s largest online retailer constitutes a minor part of much broader ambitions to expand overseas. What’s more, the commitment underlines the scale of the opportunities on offer in South Korea’s fast-growing e-commerce market.

SoftBank has invested in a string of high-calibre internet companies of late

“SoftBank aims to grow by investing in Internet companies around the world and supporting disruptive entrepreneurs who share a common vision to contribute to people’s lives through the Information Revolution,” that’s according to SoftBank’s Chairman and CEO Masayoshi Son in a press release. “SoftBank looks forward to supporting Coupang as they further revolutionise e-commerce.” The company’s Vice Chairman then went on to add that Coupang was among “the fastest-growing and most disruptive Internet companies in the world.”

The success of the e-commerce firm, which was founded first in 2010 by Harvard graduate and CEO Bom Kim, is powered by its cutting-edge delivery service and founded on its proprietary technology infrastructure. Underpinned by an extensive retail selection, the largest end-to-end fulfilment operations in the country and a homegrown fleet of “Coupang Men” to fulfil last mile deliveries, the retailer’s monthly direct revenues have more than tripled in the six months preceding June.

SoftBank has invested in a string of high-calibre internet companies of late, namely India’s Snapdeal and China’s taxi app Kuaidi Dache, each spearheaded by Nikesh Arora, who was in May made responsible for the company’s so-called second growth phase.

The Korean e-commerce market represents something of an opportunity for investors, though not so much for foreign names, who have found it notoriously difficult to crack. Neither Alibaba nor Amazon boasts a presence in South Korea, due largely to language and regulatory obstacles, yet eMarketer estimates put this year’s growth at 11 percent, making it the third-largest e-commerce market in the Asia-Pacific, after China and Japan.