Eaglestone sees a new era of opportunity for Angola

After decades of civil war, the Angolan economy is now flourishing. Experts from Eaglestone, the New Economy Award-winning independent financial services and private equity firm, explain how the government is supporting businesses and investment

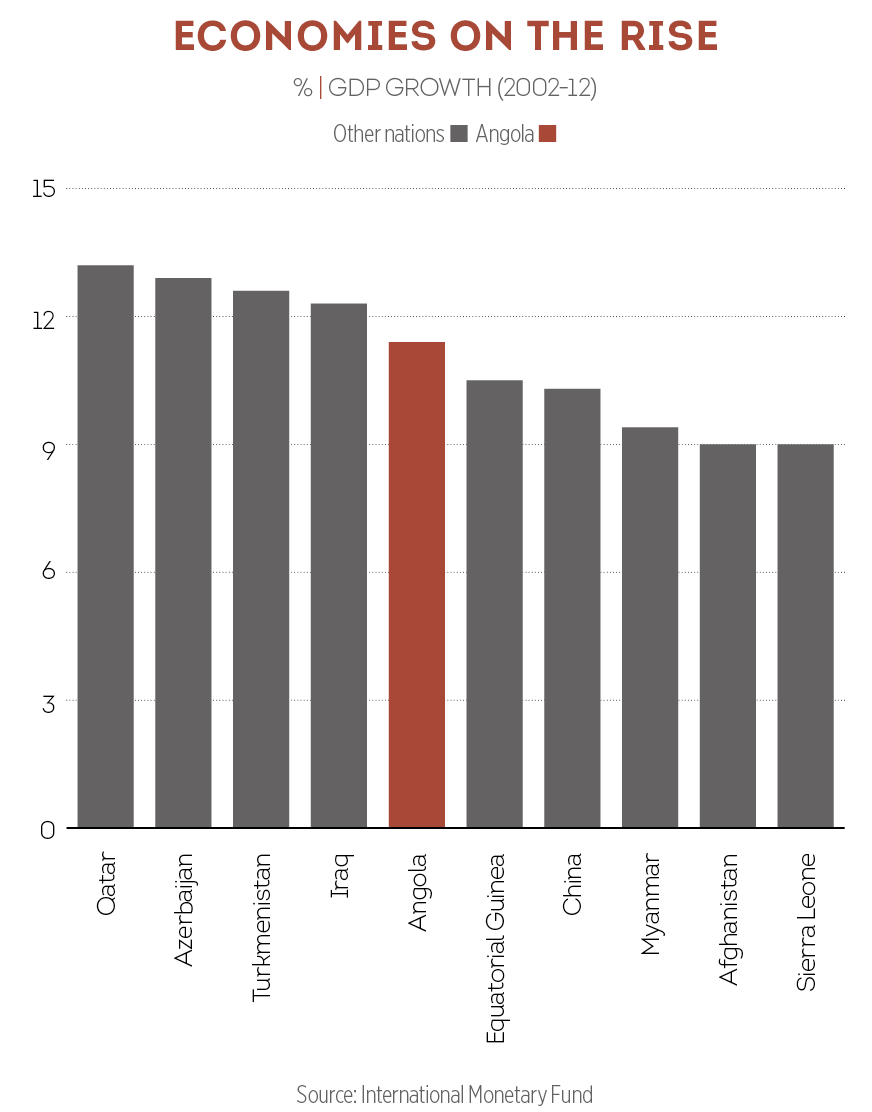

Boys walk on newly-laid railway tracks in Dondo, Angola. The country has used profits from the oil boom to rebuild its infrastructure

After decades of civil war, Angola has become one of the fastest-growing economies in the world. But the country still faces great challenges if it is to achieve sustainable growth and improve the living conditions of its population. As Pedro Ferreira Neto, Founder and Group CEO of Eaglestone, an investment banking firm focused on sub-Saharan Africa, points out: “Angola has undertaken a challenging but successful development path in the last decade, but one also finds that a lot remains to be done in terms of improving infrastructures, human capital, the business climate and the social conditions of the population. However, I am sure Angolans will make it, and we are enthusiastic about contributing to the development of the country”.

Angola has undertaken a challenging but successful development path in the last decade

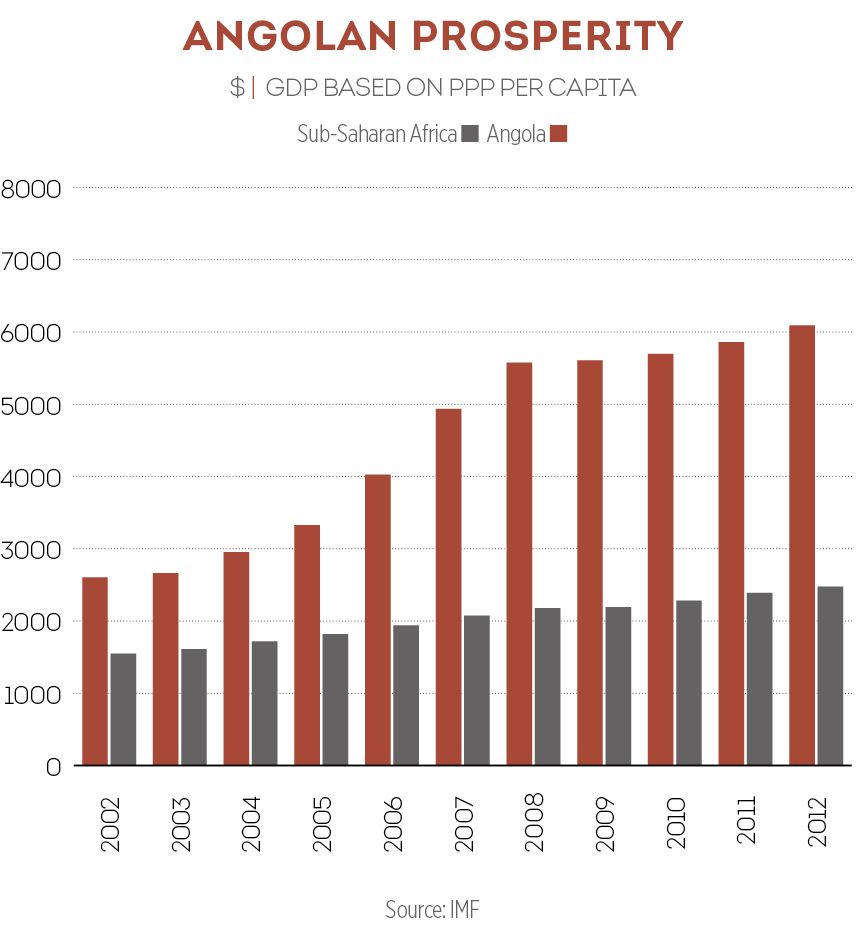

Following strong efforts to rebuild a country devastated by decades of war, Angola took advantage of the oil boom in the mid-2000s to rebuild its infrastructure and enhance overall economic and social development. A strong performance in both the oil and non-oil sectors (mostly construction and retail) has allowed per capita income to surpass $5,000, well above the average for sub-Saharan African countries.

The country currently has a positive fiscal balance and low public debt. On top of this, it has a more comfortable level of international reserves as well as a stable exchange rate, which helped lower inflation to single-digits for the first time in over two decades.

Government support

Tiago Dionisio, Head of Research at Eaglestone, notes the Angolan authorities are now focused on implementing a development strategy that will ensure stability, growth and employment in the long-run. The “Angola 2025” government development plan is targeted at reducing the poverty levels and improving the literacy and skill levels of the local population. The National Development Plan 2013-17 is part of the Angola 2025 vision and aims to promote economic diversification. Authorities hope it will help double the number of investment projects approved every year by ANIP, the national private investment agency, and create many jobs.

Government officials are seemingly committed to promoting the recovery of national production, including the revitalisation of the agricultural sector in order to reduce the country’s reliance on imported goods. High quality soil and a good water supply make farming a valuable industry for Angola, accounting for 11 percent of GDP and 70 percent of total employment. In 2013, farm output grew 8.6 percent, mostly through strong growth in cereal production. However, agriculture in general is held back by limited competition and processing.

Angola’s first sovereign wealth fund, the Fundo Soberano de Angola (FSDEA), is now operational, with a $5bn capital allocation. Headquartered in Luanda, the FSDEA investment strategy envisages the establishment of a diversified portfolio that optimises expected returns in direct relation to the forecasted long-term risk. The chairman of the board of directors of FSDEA, José Filomeno dos Santos, said the fund will ensure the allocation of approximately $2.5bn to alternative investments in the agriculture, mining, infrastructure, hospitality and real estate sectors. These large investments across Angola and other African markets will, according to Santos, “nurture sustainable domestic and regional growth”.

The Government of Angola is also trying to stimulate local business entrepreneurship by promoting co-investments through a public venture capital fund, Fundo Activo de Capital de Risco Angolano, that invests in Angolan SMEs.

Nevertheless, doing business in the country remains challenging: Angola ranks 179th out of 189 economies in the World Bank’s Doing Business report for 2014, below many other Sub-Saharan African countries. Manuel Reis, Co-founder of Eaglestone and its Country Manager for Angola, highlights that private sector development is hindered by high logistics, utilities and operational costs, with Luanda ranking as one of the most expensive cities in the world. Despite the improvements seen in the last decade, unreliable electricity, poor transportation networks and weak human capital across the country contribute to an increase in the cost of local production and to a weak business environment.

Continuing challenges

Local companies often note access to financial services remains limited and that it is a key impediment to their business activity. This is partially explained by the complex administrative procedures when opening bank accounts and obtaining loans. Banks claim it is difficult to identify borrowers with good credit risk due to a lack of reliable accounting principles and credit information. Weak contract enforcement and a lack of collaterals are also key hurdles to further credit expansion.

Reis believes the succession of President José Eduardo dos Santos is being carefully addressed in order to ensure political stability and a smooth transition, with Vice President Manuel Vicente (former head of oil company Sonangol) being referred to as a likely candidate to succeed. The adoption of a new constitution in January 2010 has established a presidential parliamentary system whereby the President is elected for a five-year period, with a limit of two presidential terms.

Despite the challenges, the Angolan economy is firmly headed in the right direction so one should be optimistic about the prospects of many Angolans rising out of poverty.