Eaglestone leads developments in Sub-Saharan Africa

Nuno Gil, Founding Partner of New Economy Award-winner Eaglestone, explains how the company’s work in Sub-Saharan Africa is informing its operations internationally

A wind farm in South Africa. The company has acted as an advisor for energy hubs in the continent, including gas fired and solar powered plants

Eaglestone is very proud to win The New Economy Award for Best Investment Advisory and Private Equity Firm in Sub-Saharan Africa. Pedro Ferreira Neto, our Founder and Group CEO, highlighted that this valuable international recognition is evidence that Eaglestone is turning into reality its vision of becoming a leading independent investment banking and private equity firm in Sub-Saharan Africa, as well as a recognition of its unmatched commercial franchise and execution capabilities in Angola and Mozambique.

Founded in December 2011 by Pedro Neto, a senior investment banker with extensive experience and knowledge of doing business in Africa, Eaglestone has since grown at a fast pace. It now has over 30 senior investment bankers with multidisciplinary skills and experience in Sub-Saharan Africa.

Eaglestone’s business model is built upon in-depth country and sector expertise

Eaglestone’s business model is built upon in-depth country and sector expertise, along with best of breed products, and technical and commercial knowhow. These are skilfully articulated to provide the structuring and execution of transactions across four principal areas. Our advisory division offers structured finance, corporate finance and project investment advice related to projects and business in Sub-Saharan Africa. This benefits local governments and multilateral entities, public and private corporations, financial sponsors and entrepreneurs.

Eaglestone Asset Management handles internationally funded private equity funds dedicated to undertaking development capital investments in the real estate, consumer, industry and infrastructure sectors in the core geographies of Sub-Saharan Africa. It does this through principal investment strategies, club deal investments and/or joint ventures.

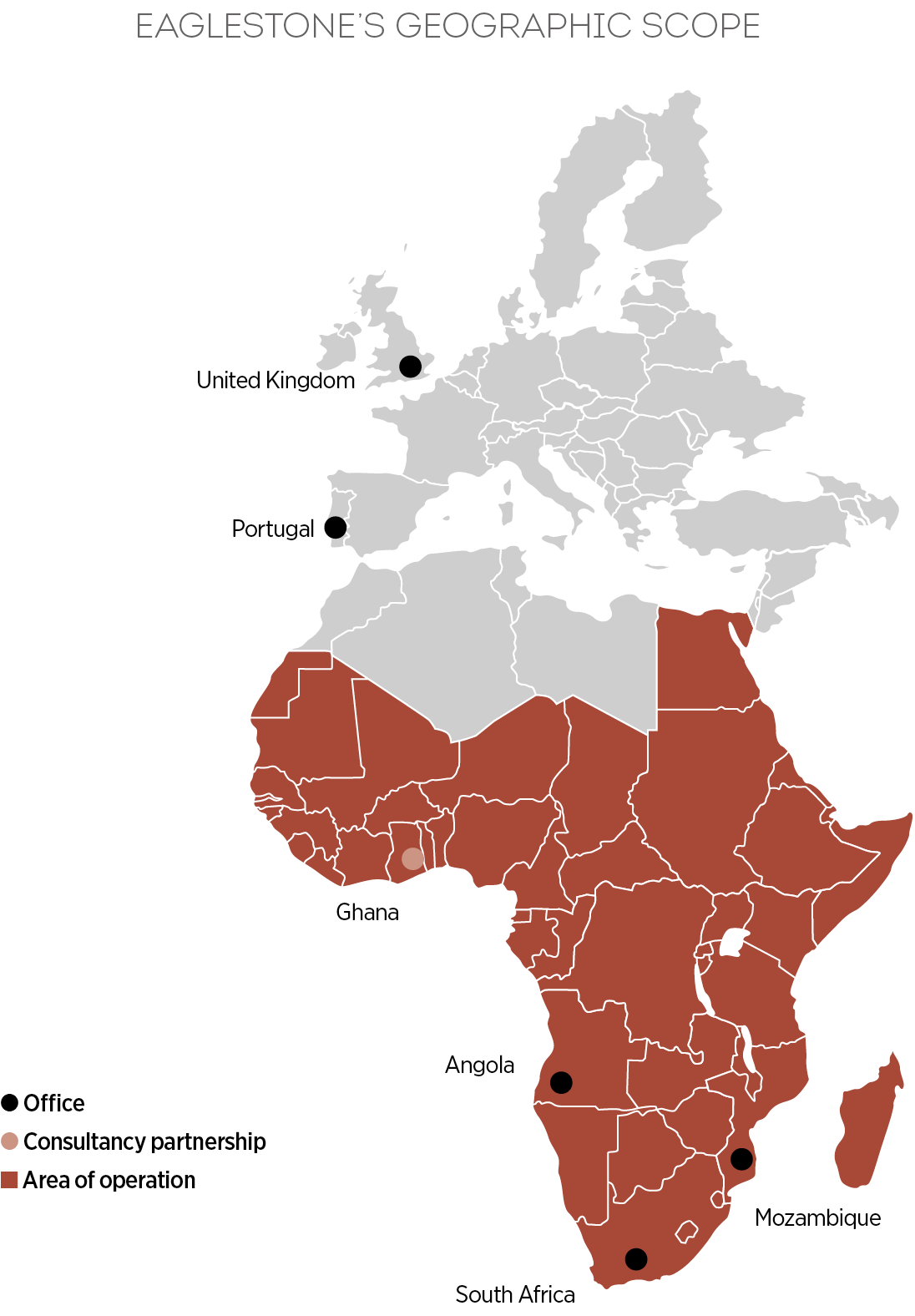

We also conduct research on Sub-Saharan Africa, offering macro, industry and corporate research notes. Eaglestone is setting up a brokerage platform in Angola, licensed by local regulator CMC. We are licensed for investment advisory and securities intermediation in the UK and Portugal. Eaglestone also handles wealth investment advice and structuring, as well as tailor-made financial, corporate and real estate investment solutions to family office and high-net-worth clients in Sub-Saharan Africa.

Benefits of the group model

Each of these business activities operates as a separate business unit with its own brand, but all benefit from the operational synergies and management structure leverage provided by the group’s integrated management. These four business activities are offered and delivered by dedicated teams spread across our offices in Luanda, Maputo, Cape Town, Johannesburg, London and Lisbon.

We have over 40 staff composed of both senior and middle managers and technical staff, with: significant work experience across 20 countries spread around five continents, with a particular focus on Sub-Saharan Africa; an extensive track record of deal-making in South Africa and Sub-Saharan Portuguese-speaking countries as well as their neighbouring countries; specialist knowhow in project investment analysis and structuring in Sub-Saharan Africa, particularly in the infrastructure, energy, resources and real estate sectors; expertise in project and structured finance, capital structuring, with over €75bn of debt arranged, structured and/or advised; knowledge of proprietary equity investment, and fundraising experience; diverse experience in arranging and placing debt and equity instruments into the local and international capital markets.

Proven capability

The quality and success of Eaglestone’s business proposition and delivery capacity in Sub-Saharan Africa is evidenced in the diverse range of deals it has executed over the past two years.

Eaglestone has acted as financial advisor: for a 100MW gas fired power plant in Mozambique; to ACED and ENEL on an 88MW wind farm in South Africa; to SolarReserve on a 100MW concentrated solar power plant in South Africa; on the sale of five renewable projects in South Africa; on the sale of equity holdings in oil drilling blocks in São Tomé and Príncipe, and in Angola.

The firm has also been involved in the development of various real estate private equity ventures in Angola and Mozambique. Eaglestone set up, and continues to fund raise for, a private equity fund specialising in general industry and consumer services for the consumer and business sectors (e.g. food and retail companies, manufacturers of goods and industrial products, and technology and IT service providers in Sub-Saharan Africa).

These accomplishments were enhanced by the top quality market intelligence and proprietary research the firm produces on the relevant sub-Saharan markets and sectors. This area of excellence boosts the prestige and knowledge of Eaglestone across the region and internationally. As Pedro Ferreira Neto says: “Despite the youth of Eaglestone’s project, we proudly managed to attain very relevant milestones. These achievements and market recognition provide us with extra motivation and energy to continue working hard to support our clients unlocking Africa’s potential.”