Cisco looks to splash the cash in territorial expansion

US tech giant reportedly looking at strategic investments in Europe and Canada after failed attempt to change US tax policy

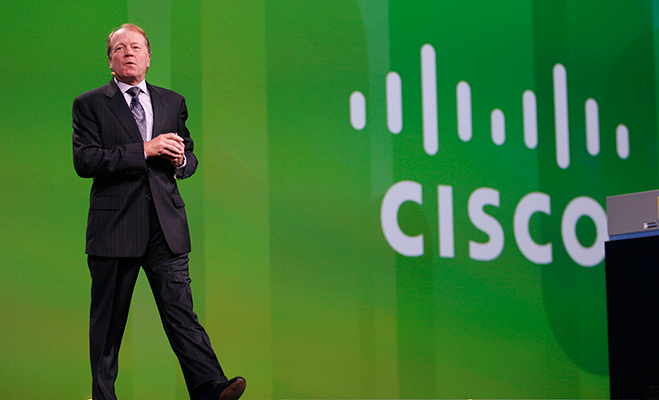

Cisco CEO John Chambers

Since an earnings call in November revealed that Cisco Systems was sitting on a cash pile of $46.4bn, many in the industry have speculated over what the company might be looking to invest in as it attempts to expand its already considerable operations.

The company’s chief executive, John Chambers, has announced that he is eager to look at opportunities in Europe and Canada, particularly in light of his failed attempt to persuade US tax authorities to change their stance on foreign cash holdings.

Many US firms in the technology sector have large amounts of cash stashed overseas, with Chambers estimating that the industry could have as much as half a trillion in cash reserves. They have been trying to avoid having a situation where they would be paying tax twice on the cash by bringing it back domestically, but have so far failed to change the stance of the authorities.

Chambers told the FT: “Over the last four to five years we wanted the US government to have a chance to provide a policy where we and others could make decisions on where we’re going to invest and where our headcount growth is going to be. It’s now at the point where we are going to go ahead and move. You’re going to see us put the cash to use.”

This could mean a considerable boost for technology sectors in Europe and Canada, with Cisco particularly looking at start-ups. Chambers is most enthusiastic about Canada, which he describes as “the easiest place in the world to do business”. He also singled out Scandinavia and Germany, while describing himself as “an optimist” with regards to the UK, which has been keen to attract overseas tech giants to invest in its burgeoning start-up sector.

In their latest earnings call in mid-February, Cisco reported that net revenue had grown five percent year-on-year to $12.1bn. Earnings-per-share reached a record level of 51 cents, more than the predicted 48 cents by analysts.