Eli Lilly bets on cancer drugs with Loxo Oncology acquisition

US drugmaker Eli Lilly has agreed a deal to purchase Loxo Oncology for $8bn, a move that will help the firm expand its capabilities in precision cancer treatments

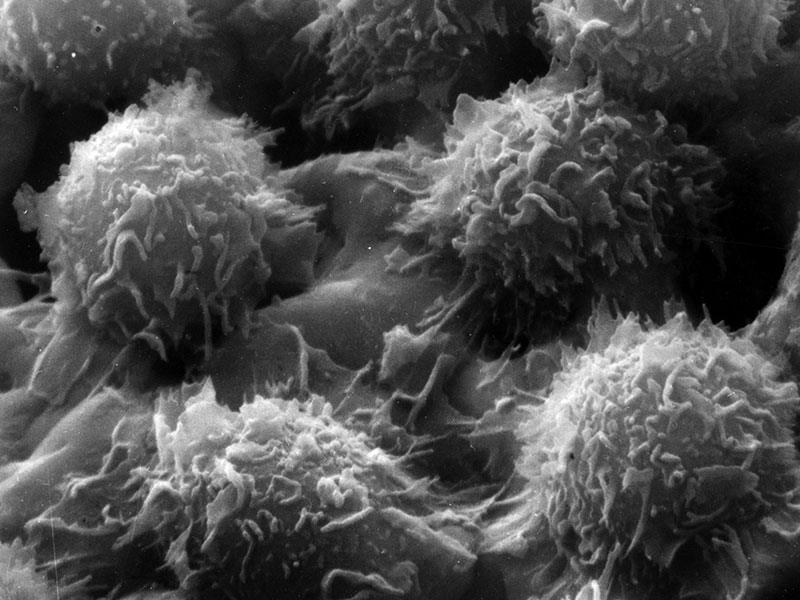

While most medicines on the market treat a single type of cancer, Loxo Oncology’s products are able to treat multiple types, as they target single gene mutations

US pharmaceuticals giant Eli Lilly will acquire Loxo Oncology for around $8bn in cash – $235 per share – as it seeks to push further into the cancer drugs market. The final sale price represents a 68 percent premium and is a substantial acquisition for Lilly, one of the world’s largest drugmakers.

Loxo, which was founded in 2013 in Stamford, Connecticut, is a specialist producer of genetically focused cancer drugs. While most medicines on the market treat a single type of cancer, Loxo’s products are able to treat multiple types, as they target single gene mutations.

“The acquisition of Loxo Oncology represents an exciting and immediate opportunity to expand the breadth of our portfolio into precision medicines and target cancers that are caused by specific gene abnormalities,” Anne White, the president of Eli Lilly’s oncology division, said in a statement.

Eli Lilly used the announcement to highlight four promising cancer treatments that are currently in development by Loxo Oncology

Lilly also used the announcement to highlight four promising cancer treatments that are currently in development by Loxo, including Vitrakvi, a pioneering oral TRK inhibitor that was recently approved for sale by the US Food and Drug Administration (FDA).

Loxo’s COO, Jacob Van Naarden, expressed his excitement for the partnership in a statement: “We are confident that the work we have started, which includes an FDA approved drug, and a pipeline spanning from Phase 2 to discovery, will continue to thrive in Lilly’s hands.”

Eli Lilly was founded in 1876 by an American Civil War veteran and has a market capitalisation of approximately $110bn. It was the first company to mass-produce insulin and the polio vaccine, but it is arguably best known for its synthesis of Prozac.

Speaking to CNBC, Lilly CEO David Ricks said the company would like to grow its presence in oncology: “We have a good set of medicines there but we’d like to expand that because there’s so much exciting science for patients emerging in oncology to invest in.”

This deal is the second large-scale acquisition of a cancer drugmaker in as many weeks: Bristol-Myers Squibb, another large American pharmaceuticals company, announced on January 3 that it would acquire cancer drug specialist Celgene for $74bn. The deal is expected to close in Q3 2019.

The global market for cancer drugs is worth around $123bn per year. With these acquisitions, both Lilly and Bristol Myers-Squibb are carving out a competitive position for themselves in the sector, adding cutting-edge treatments to their respective arsenals in the process. These deals, therefore, are strategic decisions for both companies’ product offerings and market shares.