Peru works to make up its infrastructure deficit by looking to private sector

ProInversión is turning Peru’s billion-dollar infrastructure deficit into an ambitious business opportunity by combining private investment with public sector projects

The Peripheral Ring Road project, which is currently in the structuring phase, will build a 34.8km-long beltway around Lima and Callao, with an investment value of $2.05bn

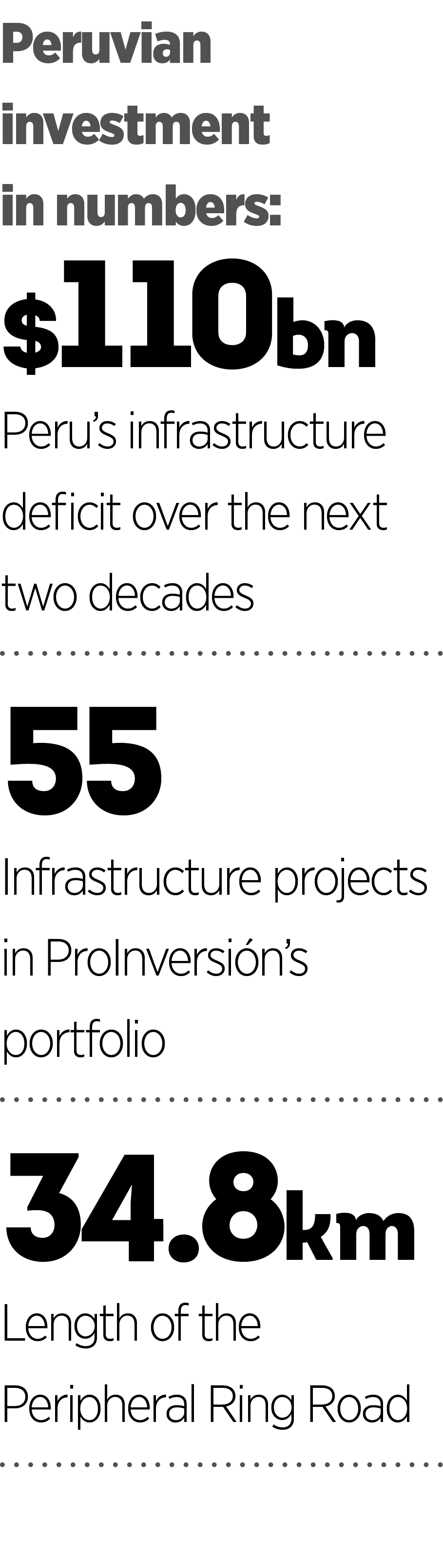

Over the past decade, Peru has become one of Latin America’s fastest-growing economies. According to Central Reserve Bank Governor Julio Velarde, the country’s average annual growth rate has been five percent over the past two decades – the highest rate in Latin America – which is thanks in large part to continued investment in its growing mining sector. However, the country’s infrastructure development has fallen behind in recent decades, meaning that the overall infrastructure deficit is set to remain at $110bn over the next 20 years.

A developed infrastructure is crucial for countries to meet their national goals and be economically successful, as it connects supply chains and allows goods and services to move across internal borders. Additionally, developed infrastructure can unite metropolitan areas and increase social mobility by granting better opportunities in terms of employment, education and healthcare.

In Peru, the current infrastructure gap presents a formidable barrier to investment opportunities. As a private investment promotion agency, ProInversión champions public-private partnerships (PPPs) in an attempt to boost Peru’s infrastructure and global competitiveness. ProInversión has strong links with the Ministry of Economy and Finance, as well as numerous government bodies for various industry sectors, making us an excellent first point of call for budding investors. Further, we have a streamlined approach, enabling us to offer investment opportunities that facilitate sustainability and social reform.

A developed infrastructure is crucial for countries to meet their national goals and be economically successful, as it connects supply chains and allows goods and services to move across internal borders

ProInversión currently identifies sectors such as transportation, energy, health, education, and water and sanitation as lucrative avenues for foreign investment. In addition, Peru’s non-discriminatory and modern legal framework creates a stable investment climate and allows foreign investors to enjoy the same rights as Peruvian investors. Demonstrating this is the projected growth of our project portfolio for 2019 to 2022, which will consist of 55 projects at a total investment value of more than $9.2bn (excluding VAT). At present, there are nine projects in the structuring phase and eight that are approaching transaction, i.e. close to bidding. As new investment ventures emerge and develop, our portfolio value could easily climb to $15bn.

Shaping the market

Peru offers private investors an eclectic range of sectors in which to do business. The use of PPPs to fund infrastructure projects has received broad support from organisations around the world. ProInversión uses PPPs for a number of reasons – first and foremost, it allows the public sector to benefit from the advantages usually associated with privately funded projects. For example, PPPs grant public sector projects access to the private sector’s research and development facilities, which can improve operational efficiency and offset some of the associated risk. Meanwhile, private sector companies benefit from the support of large international firms and government resources, thus further developing capabilities and increasing potential.

We are regarded as one of the most experienced agencies in Peru, and have been recognised as a good example for many neighbouring countries in Latin America. Our wide-ranging portfolio, combined with Peru’s macroeconomic stability, has boosted the appetite of foreign investors from across the globe.

In the driver’s seat

The transport sector is a top priority for the country at present, boasting 35 percent of ProInversión’s portfolio. Peru’s commitment to meeting its transport and logistics needs is apparent in its fiscal planning. As part of a public spending programme, the Ministry of Economy and Finance has prioritised a fund of roughly $30bn for infrastructure developments, of which over 80 percent are in the transport sector. A significant portion of the funding comes from PPP projects, with more expected to come from the private sector. For 2020, we are tapping into the many investment opportunities available along Peru’s 78,000km of roads – a fundamental aspect of the country’s transportation system, which crosses most of the mountain and coastal regions.

For example, the Peripheral Ring Road project, which is currently in the structuring phase, will build a 34.8km-long beltway around Lima and Callao, with an investment value of $2.05bn. This project will improve connections between the districts of the north and east areas and the rest of the metropolitan Lima area.

Another important project is the Longitudinal Sierra Highway, which has an investment value of roughly $900m. This project’s scope handles the improvement and rehabilitation works of an important section of the highway, which will connect 12 areas across the Andes mountain range. Meanwhile, our major rail projects include the construction of lines three and four of the metro network between Lima and Callao. Although these lines are still under formulation with the Ministry of Transport, they will directly impact the profitability and sustainability of the surrounding areas.

Social good

Water and sanitation projects form another important strand of our infrastructure strategy, comprising around 25 percent of our portfolio. Projects include increasing clean water capacity and improving waste treatment, as well as building potable water treatments and desalination plants, each of which require sizeable investment. Lima’s potable water supply project, for example, requires design work, construction and maintenance, bringing the total investment value up to $720m. Indeed, over the next 30 years the capital will see a great deal more work in sanitation: dams will be enlarged, while new canals, water transfer tunnels and reservoirs for treated water will be built.

Another important sector with a vital social impact is health. Although Peru has traditionally suffered from restricted access to healthcare services, significant steps have been made in achieving universal coverage in recent years. In particular, the Universal Health Insurance Law, which was signed in 2009, was a major step towards this goal.

At present, our portfolio has five commissioned hospitals set for 2020, covering both their operation and maintenance – a fundamental concession that is becoming the norm in projects across all industries. The total investment for next year through ProInversión into Peru’s health sector totals $591m.

After two decades of stable economic growth, Peru increasingly finds itself in a position to invest in resources for education. Following the Peruvian Government’s 2015 initiative to improve the population’s English skills, the number of applicants to English-language degrees is expected to rise. The number of schools and educational institutions teaching in English is already increasing in response to demand from local corporate sectors. ProInversión has five important projects designed to improve the quality of education by giving a boost to each respective school’s infrastructure, guaranteeing they remain in operation throughout the concession period. This investment amounts to around $301m.

An attractive framework

The opportunities across these sectors are coupled with Peru’s favourable legal framework. Foreign investors receive non-discriminatory treatment and thereby unrestricted access to most economic sectors, as well as enjoying free transfer of capital and shares. The framework also grants the freedom to both purchase stocks from locals and access internal and external loans. Finally, owing to the political stability Peru has enjoyed in recent years, buyers are guaranteed to retain any private property they purchase.

At ProInversión, we’re proud of our three-pillars strategy, which we believe sets us apart from other agencies in the region that use the PPP model

In the event of litigation, investors have access to international dispute settlement mechanisms. Peru notably participates in the Investment Committee of the Organisation for Economic Cooperation and Development (OECD), which promotes the implementation of environmental and social guidelines for multinational enterprises. Peru is a strong candidate to become a member of the OECD in the near future.

Ultimately, a stable legal framework helps to facilitate profitable projects. What’s more, ProInversión recently simplified the legal process to hire the best technical, legal and financial firms to serve as advisors and to strengthen the formulation and structuring phases of projects we collaborate on.

The Peruvian Government also recognises how tax regimes can further incentivise private investment. An example is the VAT refund scheme, which grants any company the right to recover the VAT of an investment valued above $5m within a preoperative stage of more than 24 months. Significantly, ventures within the agricultural sector do not need a minimum investment capital requirement to qualify.

Support from within

As the organisation that promotes the country’s private investment policy alongside the Ministry of Economy and Finance, we are best placed to support investors in breaking into the Peruvian market. We provide crucial information and guidance to investors, with the aim of creating a conducive and fruitful environment. For example, sector officers are available across the board to provide information on all our projects and mechanisms. Through this approach, ProInversión can effectively channel information requests from investors to experts in the relevant sector to aid investors’ understanding of market conditions.

ProInversión employs a triple-pronged approach to ensure the very best projects are brought to market. We are often the main contact for investors due to our ability to identify and liaise with the various ministries, regulatory authorities and entities governing a particular sector’s environment. Importantly, we also work with the best advisory firms (technical, legal and financial) to guarantee the project’s execution and maintain a great relationship with the investor from beginning to end. We also believe that opening a dialogue with the communities affected by the projects is vital to any initiative’s ultimate success.

Finally, it’s also important to develop a promotional plan based on a commercial strategy that leads us to the market: this should include identification, segmentation and customer satisfaction. ProInversión ensures the projects it supports are sustainable by observing the life cycle of numerous PPP projects and their five phases (planning and scheduling, formulation, structuring, transaction and contract execution). This guarantees quality at every stage of development.

Internal strategy

At ProInversión, we’re proud of our three-pillars strategy, which we believe sets us apart from other agencies in the region that use the PPP model. The first pillar is the hub of excellence: we continually strive to achieve excellence when advising the government on the formulation and structuring of PPP projects. This is made possible by recruiting top-tier consulting firms and facilitating standardised contracts that ensure predictability within any given market.

Our second major focus is to promote private investments with productive, social and environmental management at their core. We recognise the value of social and environmental consciousness in our work in order to guarantee sustainable and successful projects that are equally beneficial to society and the population of Peru. This ethos is exemplified by a project that we are particularly proud of – the wastewater treatment system within Lake Titicaca. ProInversión granted this project, which is located in the Puno region – one of the poorest in Peru – under a co-financed and private initiative. It designed a solution for the treatment and final disposal of municipal wastewater in Lake Titicaca, consequently decreasing pollution in this sensitive area of Puno. In the awarding process, ProInversión conducted an international public tender, which had five potential bidders.

The completion of the Lake Titicaca project will help to reduce the water sanitation gap in the country by improving a public service for the benefit of all citizens in Puno. This is especially important as, for ProInversión, a project’s significance also lies in its social impact. The project will provide benefits for more than 1.2 million Peruvians across 10 towns in the Puno region by improving public health, increasing commercial activity and creating an overall positive impact on the region’s progress.

The third pillar is our commercial strategy. Here we have been applying a systematic and informed methodology to identify, consolidate and attract potential investors. Our commercial intelligence is highly specialised to retain the right investors for each project. We will continue to participate in local and international campaigns, as well as utilise digital tools to keep attracting first-rate investors who are highly committed to our growing economy.

Peru’s VAT refund scheme grants any company the right to recover the VAT of an investment valued above $5m within a preoperative stage of more than 24 months

Looking forward

With growth and internal development as an unwavering priority, plans for the future at ProInversión are varied and numerous. Having recently presented the National Infrastructure Plan, which was issued by the Ministry of Economy and Finance, we have an infrastructure development agenda in place to help support our long-term vision. What’s more, prioritisation of our projects further helps to anchor and manage the expectations of our stakeholders.

Our key objective is to reduce the $110bn infrastructure gap over the next 20 years. Investing capital to close the gap is a huge investment opportunity that is expected to return quick dividends. Furthermore, we are currently collaborating with a top consulting firm to finalise a financial guideline to standardise the development of financial models in the structuring stage. In a similar sense, in order to improve efficiency, reliability and transparency, we have retained the services of a leading Anglo-American law firm that is in the process of finalising a contract for the standardisation of PPP projects. To complement these initiatives, we have begun internal discussions to establish a project management department in each government ministry that is looking to further optimise the project’s formulation.

Stepping into the digital transformation sphere, we have been put forward by the Inter-American Development Bank as one of the countries to incorporate the online data management platform Source. This will keep track of our portfolio and monitor project milestones, ensuring accountability at every stage. Another benefit of this digital platform is being able to follow the development of projects with corresponding and integrated data. Source is a tool that will allow us to plan our project’s next steps accurately and efficiently.

These new developments will provide us with fresh impetus and insight into the future of our project portfolio, which is expected to reach the $15bn mark as more mandates continue to be allocated in the transportation and sanitation sectors.