Saudi Arabia’s economy heats up thanks to solar energy

One of the biggest oil producers in the world is set to invest heavily in solar power, marking a turning point for a once troubled industry

Oil has been having a tumultuous time recently, and so - to cope with the strain - Saudi Arabia has turned to solar power. One expert has said that this move "could change the fundamentals of the oil market"

It’s fair to say the last 12 months have come as a shock to the oil industry. The collapse in prices of crude has been exacerbated by geopolitical events, not least those in Ukraine and across the Middle East. At the same time, major oil-producing countries, led by Saudi Arabia, have maintained high levels. The resulting plunge in the price of oil may have been welcomed by consumers, but is causing great concern for both the industry and investors.

Looking for an alternative method of powering an increasingly energy-demanding world has led many to talk of a resurgence in the solar power industry. Once hailed as the future of energy generation, the solar industry took a serious hit to its credibility after a series of much-touted companies collapsed, partly due to the cost of the technology. Since then, however, the industry has managed to bring down prices substantially, and solar energy has become a genuine alternative to oil.

There is perhaps no more ringing an endorsement than the proclamation from Saudi Arabia’s oil minister, Ali al-Naimi, in May that he expected solar power to surpass oil within the next 25 years. For the man in charge of an industry so integral to the country’s economy to sound its death knell, the alternative must really be about to hit the mainstream.

Al-Naimi told a business and climate conference in Paris that the days of our reliance on oil and gas appeared numbered. “In Saudia Arabia, we recognise that, eventually, one of these days, we’re not going to need fossil fuels”, he said. “I don’t know when – 2040, 2050 or thereafter. So we have embarked on a programme to develop solar energy. Hopefully, one of these days, instead of exporting fossil fuels, we will be exporting gigawatts of electric power.”

23%

Increase in US electricity drawn from renewable sources in 2014

$150bn

Global solar investment in 2014

Oil’s days numbered

Al-Naimi’s comments aren’t new for a Saudi oil minister: as reported in the last issue of The New Economy, Saudi Arabia’s former oil minister, Sheikh Yamani, told The Daily Telegraph in 2000 that demand for oil would be far less by 2030 as a result of new technologies. “30 years from now, there will be a huge amount of oil – and no buyers”, he said. “Oil will be left in the ground. The Stone Age came to an end, not because we had a lack of stones, and the oil age will come to an end not because we have a lack of oil. On the supply side, it is easy to find oil and produce it, and, on the demand side, there are so many new technologies, especially when it comes to automobiles.”

Because of this ticking clock for the oil industry, Saudi Arabia has seemingly begun to try and get as much of its oil as possible out of the ground now, resisting calls from the US to slow production in order to prop up global crude prices. The impact on prices has caused many US producers to halt exploration and production efforts in their own territory, and increased pressure on Russia’s sanction-hit economy that relies so heavily on oil production.

However, while Saudi Arabia is trying to get whatever it can for its oil now, it is also looking further ahead to the day when nobody wants to buy crude. Solar power has emerged as the leading source of renewable energy in recent years, and one that many in the industry think will dominate global power consumption within a couple of decades.

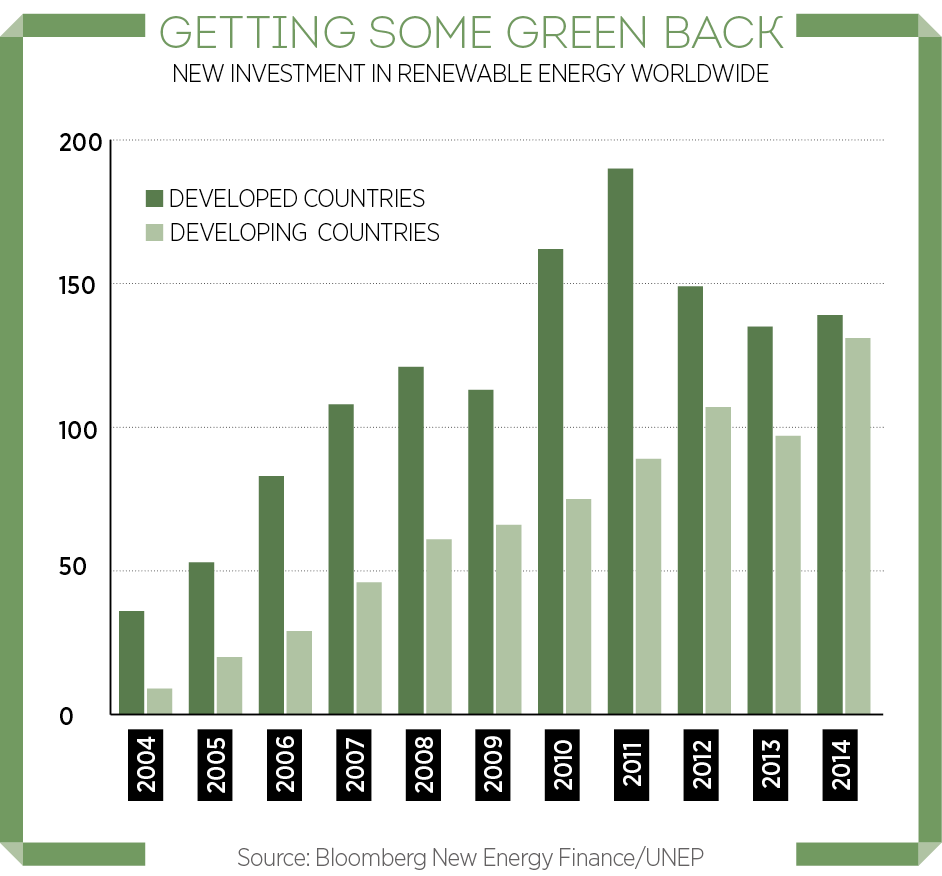

Last year, the US Energy Information Administration reported electricity generation from renewable power surged 23 percent during 2014. Much of this was down to the astonishing growth of companies such as Elon Musk’s SolarCity, which tripled in value in 2013. In 2014, the global solar industry saw investments of $150bn.

Saudi’s investing

However, the solar industry has had a turbulent history. Despite being bolstered by generous government subsidies in many countries, the industry struggled to generate enough power to make the high cost of the technology sustainable. Solyndra was among the high-profile failures, costing US taxpayers $530m when it fell into bankruptcy in 2011.

Saudi Arabia’s investment in the industry will be considerable, with the country claiming it eventually wants to be entirely powered by renewable energy. In order to achieve this, in 2012 it announced a $109bn solar plant, although that was later delayed by around eight years.

Speaking to The Guardian in June, Mark Fulton, former Head of Climate Research at Deutsche Bank and now advisor to the Carbon Tracker Initiative, said the news of Saudi Arabia’s focus on solar power could prove a turning point for the energy industry. “Saudi Arabia is sending a strong signal to all oil producers and companies they must plan for an energy transition”, he said.

Echoing these sentiments was the Carbon Tracker Initiative’s Head of Research, James Leaton, who added in comments to The Guardian: “If Saudi Arabia is starting to hedge its bets by developing solar capacity, this could change the fundamentals of the oil market.”

Other countries are taking the industry seriously too. China is investing heavily in solar power, and has also helped drive down the cost of photovoltaic panels. Industries previously reliant on fossil fuels – notably the car industry – are also now using electricity as the basis for their future energy needs.

The proclamations over solar energy’s potential by Saudi Arabia come in the lead up to a crucial summit on climate change at the end of the year. The UN will meet in Paris in December to discuss what countries must do to bring down their carbon emissions and combat the effects of climate change. With such a heavy exporter of oil touting solar as the future of the energy industry, it seems as though countries are finally looking at their longer-term energy needs.

According to the International Energy Agency, if countries agree to new climate change targets, renewable energy could overtake oil and coal as the world’s primary fuel within 15 years. At the centre of this will be a solar power industry that has bounced back and now offers the world a serious alternative to polluting fuels.