Bernanke’s last call: Fed to slash stimulus programme by $10bn

Regardless of emerging market chaos and disappointing jobs data, the Federal Reserve looks to rein in its asset purchases further still

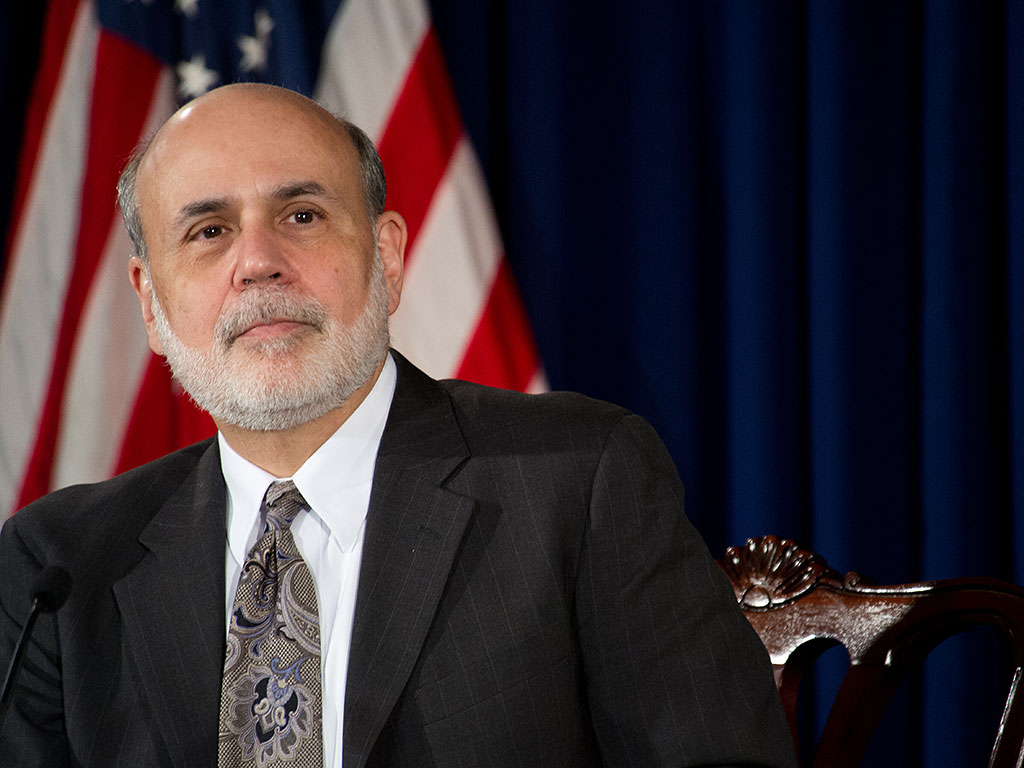

The decision to pull back the Fed's stimulus program by another $10bn will be Ben Bernanke's last as chairman. His replacement, Janet Yellen, is due to begin in February

Regardless of a recent spat of volatility in emerging markets, the Fed is reducing its stimulus programme by a further $10bn, bringing the value of asset purchases back to $65bn per month.

“Beginning in February, the committee will add to its holdings of agency mortgage-backed securities at a pace of $30bn per month rather than $35bn per month, and will add to its holdings of longer-term Treasury securities at a pace of $35bn per month rather than $40bn per month,” the institution said in a statement.

[I]t can be surmised that the Fed believes the losses in emerging market assets to be of insufficient scale to trouble the US economy

The Fed’s announcement neglected to mention the turmoil in emerging markets, though the taper will no doubt up the pressure on countries such as Turkey and South Africa, whose central banks have already raised interest rates to bolster their enfeebled currencies. From this it can be surmised that the Fed believes the losses in emerging market assets to be of insufficient scale to trouble the US economy.

The reduction is equal to December’s $10bn cut and many analysts expect the reductions to continue at quite the same pace from hereon, in effect bringing the institution’s bond-buying programme to a close by year’s end.

Although the Fed recognised a good few weaknesses, namely a slower recovery in the housing sector, below-par inflation and weaker-than-expected jobs data, the taper is evidence that the institution believes the economy is on track.

“The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate.”

The decision will be Bernanke’s last as chairman, as he prepares to hand over his role to Janet Yellen in February. The changeover will mark the end of Bernanke’s eight year term as chair, through which he has negotiated the worst financial crisis since the Great Depression and succeeded in returning the economy to a reasonable standard of health.