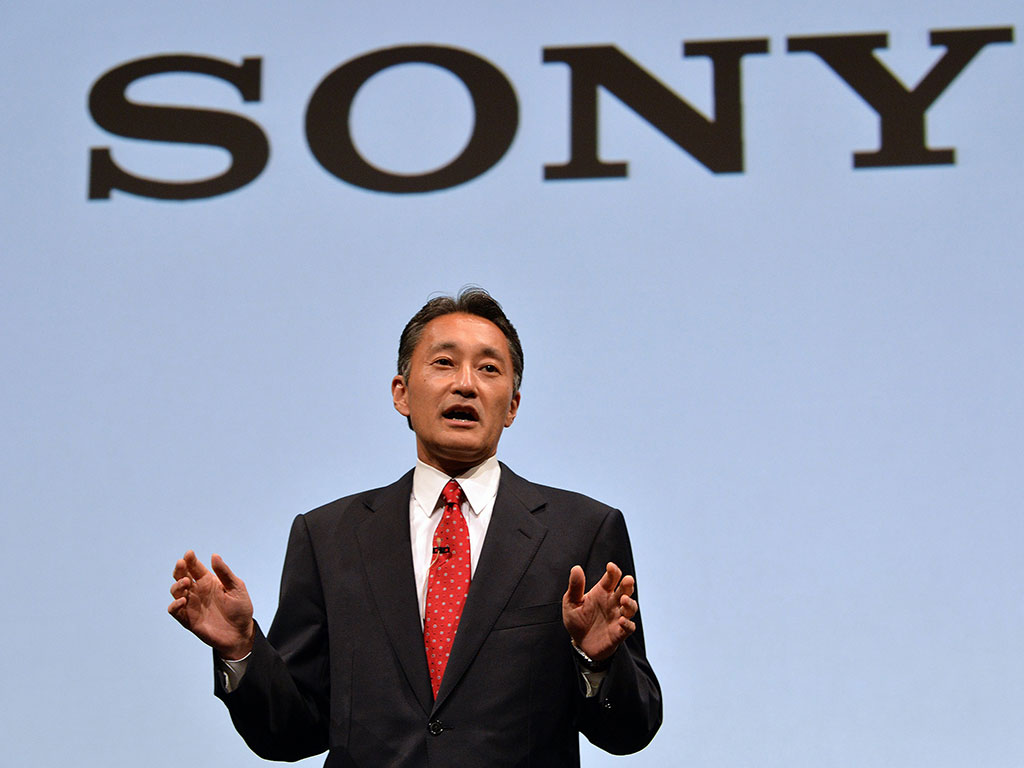

Sony gives CEO another chance

In what is fast proving a nervy period for underperforming Japanese companies, Sony’s shareholders have chosen to keep Kazuo Hirai on as CEO

Sony CEO has made it for another term despite opposition from firms such as Institutional Shareholder Services

Sony shareholders have agreed to look beyond a turbulent year for the struggling company and re-elect Tokyo-born chief executive Kazuo Hirai to his post. At the company’s annual general meeting, 88 percent of shareholders voted in favour, despite a string of heavy losses, dismal shareholder returns and a cyber security scare in the last 12 months.

The support suggests that the overwhelming majority are confident in Hirai’s ability to turn things around

The re-election was made to seem all the more important in light of a new corporate governance code, introduced recently to preserve shareholder value and make companies more accountable for their actions. The likes of Sony, Sharp and Sumitomo Mitsui Financial Group are bracing for a new era of transparency, and for greater repercussions across the board for any failure to comply with the new rules. Already the code has shown itself to be successful on one front, with more than 90 percent of those listed on the Tokyo Stock Exchange’s first section having appointed at least two external directors, up from 74 percent the year previous.

Some critics are of the opinion that Sony has failed to deliver shareholder value as best it could, and went on to assert that Hirai was unfit to lead after the company’s recent showings. Proxy advisory firm Institutional Shareholder Services encouraged shareholders to vote against Hirai in light of the company’s failings, and noted that, in the last five yeas, the company’s average ROE was minus 7.7 percent.

Still, the 88 percent vote in favour was only one percentage point short of last year’s outcome, suggesting that the overwhelming majority are confident in Hirai’s ability to turn things around. Sony recently created separate divisions for its personal computer and electronics divisions and has pledged to focus on profitability ahead of volumes in a bid to overturn its losses.