Apple’s new streaming platform shakes up the music industry

Apple’s recently launched streaming service has been hailed by major record labels as the tipping point for the industry, but it could have a devastating effect on smaller players

Haters gonna hate: Apple agreed to change its payment policy following criticism from Taylor Swift. The singer said: "I find it to be shocking, disappointing and completely unlike this historically progressive company" to not compensate the musicians it streams

When Apple introduced the iPod to the world in 2001, it was the company’s first major foray into the music industry, enabling users to carry around thousands of songs in a small digital player. The iPod was by no means the first MP3 player of its kind, but it was the first to take digital music to a mainstream audience.

Two years later, when the company launched the iTunes Store, it was heralded as the saviour of recorded music. With the industry desperately slow to react to the advent of file sharing and pirate download sites, the launch of an online store for downloading legal music files was particularly welcome.

Late to the party

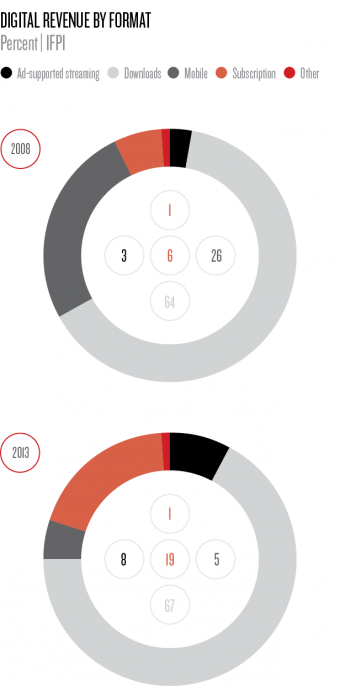

However, times change and so has the industry’s ability to sell music individually. Download sales have declined in recent years, falling by around 14 percent in 2014. This is thought to be down to a new ‘all you can hear’ subscription model that has started to become the favoured way of listening to music, making downloads seem as out-dated as the CDs they superseded. Services such as Spotify, Rdio and Deezer emerged a few years ago, offering subscribers a huge collection of music to listen to at their pleasure. As a result, Apple’s dominance of the music retail industry has waned, with download sales in the iTunes Store slumping.

Change in US music sales/streams, 2013-14

-15%

CDs

-13%

Downloads

+54%

Streams

Now, however, the company is fighting back. In June, it launched Apple Music, a streaming service that combines users’ existing music libraries with more than 30 million tracks. As is ever the case with Apple, it has hailed its new product as a revolutionary, unique and entirely original entrant into a stagnant market. Music-streaming services have, in fact, been around for a number of years, and Apple has in the past even denounced them as not being the answer to the music industry’s problems.

In order to differentiate itself from these services, Apple has said it won’t offer a free, advertising-supported option that has been popular with other providers. It is also talking up the social media aspect of Apple Music, dubbed Connect, which will allow artists to share exclusive content with followers.

One of the most striking features of the new platform is a recommendation service powered mostly by human experts. Whereas rival services have relied heavily on computer algorithms for their recommendations, Apple feels that having a human touch will allow listeners to discover music in a similar sort of way to before the advent of the internet. Underpinning the service will be playlists made by musicians, music journalists and other tastemakers. At the same time, Apple is heavily touting its new Beats 1 radio station, which will have shows by influential former BBC Radio 1 DJ Zane Lowe, as well as famous musicians.

Utilising the extensive contact book of Beats founders Dr Dre and Jimmy Iovine, Beats 1 and the curated playlist service will likely attract a huge number of users from rival services who want tailored and more intelligent recommendations for their

listening habits.

Another recently launched streaming service has attempted to do the same, although its early adoption rate has been disappointing. Tidal, a streaming service launched a few months before Apple’s by hip hop mogul Jay Z, has touted its heavy artist integration within the service. Musicians including Madonna, Jack White, Jay Z, Beyoncé and Daft Punk all have stakes in the business, and there have been promises of exclusive content from them. However, the service has been criticised and called a vehicle for already rich artists to get even richer.

Spotify dominant

Spotify’s emergence as a major player in the global music business over the last few years came as somewhat of a surprise to Apple, which had for many years claimed streaming services were not the answer to the music industry’s problems. The Swedish company launched in late 2008, backed by funding from a number of leading record labels. It has steadily grown its user base, primarily on an advertising-supported free model. For users who don’t want adverts, a subscription premium service is also available, and was what the company and industry hoped most users would adopt. However, after seven years of operation, Spotify has over 75 million users, but just 20 million paying for the premium service.

The company’s founder and CEO, Daniel Ek, has long talked of how streaming services offer the best possible future for musicians, but has faced growing criticism from artists who feel they don’t get paid enough from the company. While US pop star Taylor Swift was a high-profile critic of the service and withdrew her music, it is smaller artists who suffer the most from a lack of payment. As a result, many musicians and smaller record labels have continued to keep their music off the service, instead preferring Apple’s iTunes download store.

Speaking to music industry journal Billboard shortly after launching Apple Muisc, Iovine said he felt a considerable amount of pressure to get the platform right, coming from the music industry himself: “If we get it right, none of this matters. If we get it right, everything is smooth. I think Daniel Ek has done an incredible job so far [with Spotify] – having to make those deals like he did in those early days. There’s a lot of people doing good work [sic]. And now we’re doing this and it’s very musical. We get to move the needle of popular culture, which is the Holy Grail. When you do that — and who’s done that more than these guys – it’s a rush. Having a hit is nice, having some success, but when you move popular culture, that’s a high.”

Alongside Iovine in the interview was Apple’s longstanding Senior Vice-President of Internet Software and Services, Eddy Cue. For years, Cue has been in charge of discussions with the music industry over Apple’s various services, and he says it is this decade-plus relationship that meant negotiations weren’t as fraught as they could have been. “The great thing about the labels is we go back a long time now – more than a decade – and I think over the years we’ve learned a lot about each other and we built a trust factor. When we started, everybody said, ‘No one’s going to buy a song for 99 cents’, but they did. Did we always agree on everything? No, but I think it allows for some great discussions.”

Cue added the music industry is a particularly difficult one: “Part of the challenge that you have with labels – it’s much easier for me to sit across from you and we can negotiate and get something done, but you can’t do that with labels. Because there [are] many of them and then there’s publishers and collecting societies, so you’re having to convince a vast number of people to a common cause because all of them have a different opinion and a different priority.”

While many of these various parties have been reticent to allow the biggest online music retailer to shift towards a subscription model, the company’s huge reach has meant some feel Apple could be the company that makes streaming profitable. Sony Music CEO Doug Morris has also discussed Apple’s new platform and how he expects it to be a “tipping point” for the industry, by pushing more and more people towards signing up to streaming services. Speaking at the Midem international music conference just before Apple Music launched, Morris asked: “What does Apple bring to this? Well, they’ve got $178bn in the bank. And they have 800 million credit cards in iTunes. Spotify has never really advertised because it’s never been profitable. My guess is that Apple will promote this like crazy and I think that will have a halo effect on the streaming business.”

Morris added that he felt Apple’s launch would not be the death-knell for other streaming services, but instead help them to sign up more customers. “A rising tide will lift all boats. It’s the beginning of an amazing moment for our industry.”

Finding a fair price

Not everyone in the industry has been so welcoming of Apple’s new service. Independent record labels greeted the news with complaints over the amount of money being offered for streaming rights. The US independent music lobby group A2IM warned its members not to sign up to Apple Music under the original deal. “Independent rights holders will receive no compensation for their content during Apple Music’s 90-day free trial period,” it said. “It is surprising that Apple feels the need to give a free trial as Apple is a well-known entity, not a new entrant into the marketplace. Since a sizable percentage of Apple’s most voracious music consumers are likely to initiate their free trails at launch, we are struggling to understand why rights holders would authorise their content on the service before October 1.”

The UK’s leading music industry lobbying organisation, UK Music, said smaller labels would suffer badly as a result of the three-month free trial. UK Music’s Andy Heath told The Daily Telegraph in June: “If you are running a small label on tight margins you literally can’t afford to do this free trial business. Their plan is clearly to move people over from downloads, which is fine, but it will mean us losing those revenues for three months.”

The British independent label body, the Association of Independent Music (AIM), also sent a letter to its members in June, declaring it was “not satisfied that the deal being offered under this new initiative is fair or equitable to independent music companies”. Labels are being offered 71.5 percent royalties for streams, which is 1.5 percent more than the rate companies such as Spotify pay. However, due to the three-month free trial period, labels were initially told they would not receive any payment until the full subscription kicked in. It was during this period that they feared the industry would lose most.

Recognising Apple Music had “great potential”, AIM’s CEO Alison Wenham added: “The main sticking point is Apple’s decision to allow a royalty-free, three-month trial period to all new subscribers. This is a major problem for any label that relies on new releases rather than deep catalogue as the potential for this free trial to cannibalise not only download sales – which remain a very important revenue stream – but also streaming income from other services is enormous.”

Wenham also criticised the speed at which the platform had been launched, and the lack of consultation with smaller industry players. “However, the speed at which Apple has introduced their plans and its lack of consultation with the independent music sector over deal terms (despite what Jimmy Iovine might claim) has left us with the uneasy feeling that independents are being railroaded into an agreement that could have serious short-term consequences for our members’ interests.”

Echoing these sentiments was the Australian Independent Record Labels Association, which published the same statement as AIM. Leading UK independent label Beggars Group also said it was concerned about artists releasing albums in the three months before the trial ends. The company also said the free trial would also damage the ‘freemium’ model employed by other ad-supported services, adding in a statement: “We fear that the free trial aspect, far from moving the industry away from freemium services – a model we support – is only resulting in taking the ‘mium’ out of freemium.”

The furore became headline news when Taylor Swift publicly criticised the company and pulled her latest album from the platform. Swift’s words were particularly strong. “I find it to be shocking, disappointing and completely unlike this historically progressive and generous company”, she wrote in an open letter, adding: “We don’t ask you for free iPhones. Please don’t ask us to provide you with our music for no compensation.”

Her words seemingly hit home: Apple performed a dramatic U-turn. Just a week before launching the service, Cue announced all artists would be paid during the three-month free trial.

Downloads not dead

The steady shift over the last few years towards subscription models has dramatically changed how people interact with their music. It is clear the days of music ownership are in decline, and people will now pay companies such as Apple and Spotify for access to huge libraries.

For all the talk of a revolutionary new way of accessing music, the new system is in fact closer to what came before recorded music became popular a century or so ago. Then, artists made their money through live performances and radio plays. It was only when people were able to buy records that a listener could actually take home the music and listen at will. Apple evidently feels that promoting radio and social aspects to the musicians it has the rights to will cause them to increase their audiences, allowing them to better engage with fans. This could in turn lead to paid-for live performances.

Despite this, there are still many people who will want to own their music outright. Recognising this, Cue told Billboard music downloads are still going to be around for a long time. “Music downloads have gone down a little bit, not a lot, so this is not a crater. There are lots of people who are very happy downloading and I think they’ll continue to. Will people now subscribe? Of course, and some of our customer base will stop downloading in general. But if you’re a downloader today, you’ve got a new music app that’s got a great set of features for you.”

Spotify followed up Apple’s launch with the announcement of a $500m funding round that it will use to boost marketing and expand its services to new markets. Tidal is also likely to invest heavily in ensuring it has a number of different services to Apple. With streaming the new popular method of listening to music, artists can only hope that this increased competition – and Apple’s big splash into the market – will finally get them the revenues they deserve. Getting artists – big and small – paid properly must be the priority for these services, because, without new music, users will quickly lose interest.